Borrowed Time: Two Centuries of Booms, Busts, and Bailouts at Citi: Freeman, James, McKinley, Vern: 9780062669872: Amazon.com: Books

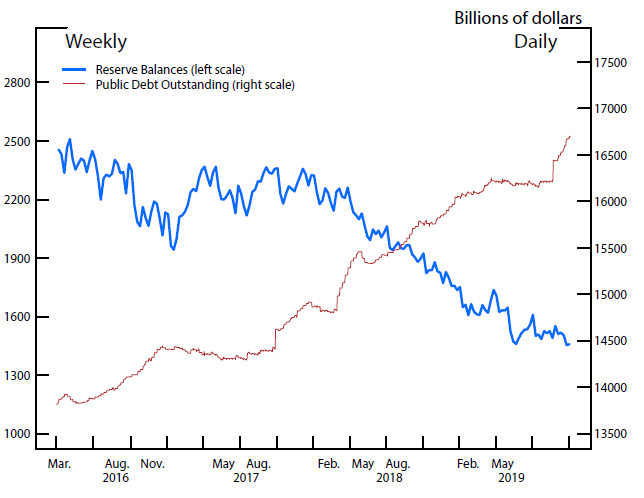

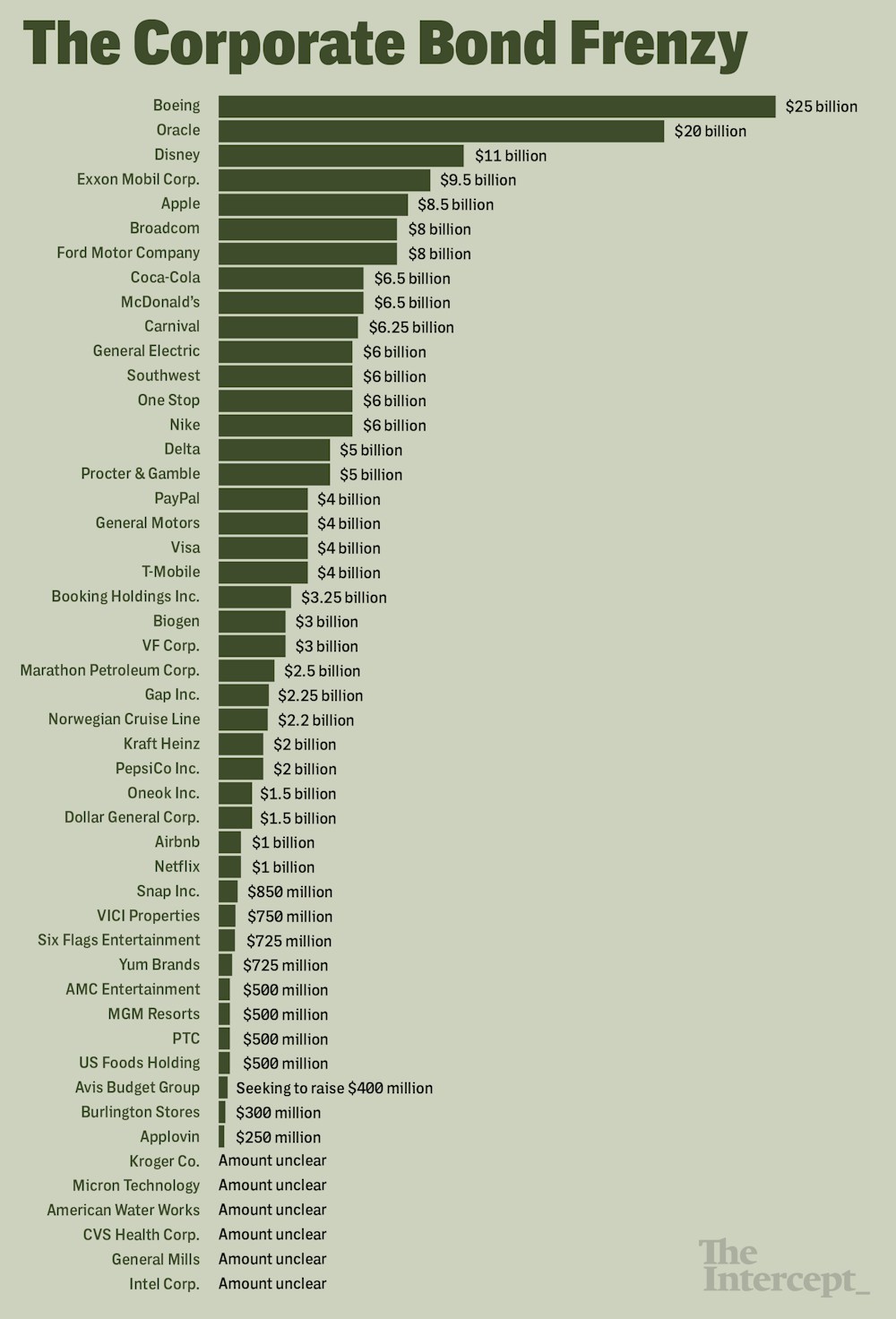

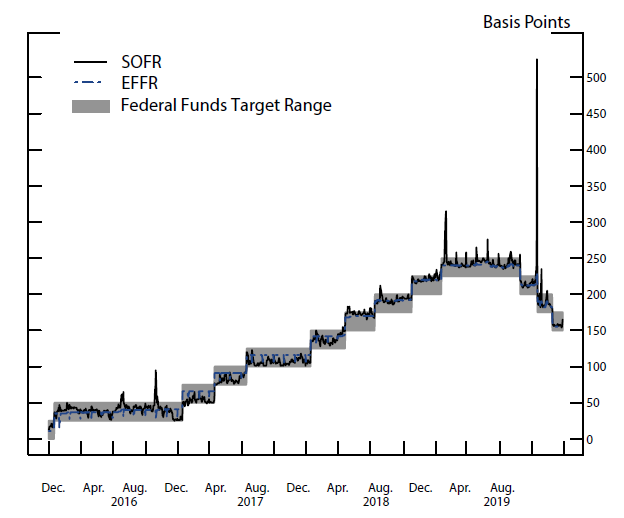

Fed's Powell Admits a Bigger Bailout for Wall Street Is Coming; Fed's Balance Sheet Ballooned by $176 Billion Since September

The reason there is a news blackout of the Fed's secret bailouts of 2019 is that the Fed would be forced to admit that it had to secretly bail out the affiliates

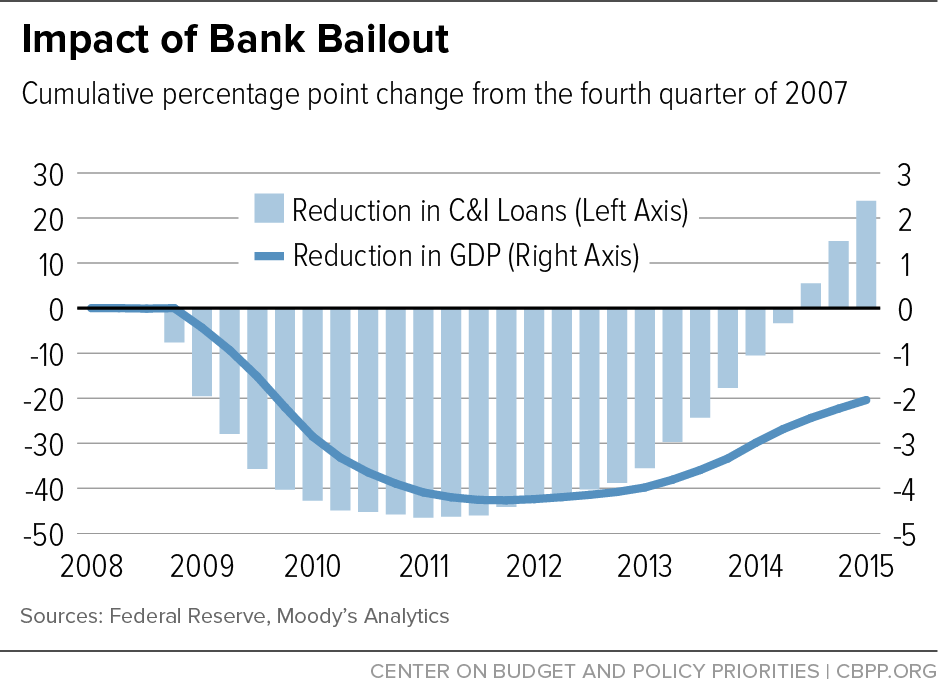

Dealing with the next downturn: From unconventional monetary policy to unprecedented policy coordination , SUERF Policy Notes .:. SUERF - The European Money and Finance Forum